Inventory Management Data Model | Subject area: SUPPLIER

Subject area: SUPPLIER

Inventory Management Supplier database design for the best Inventory Management Supplier database schema. Supplier table for Inventory Management example.

Overview

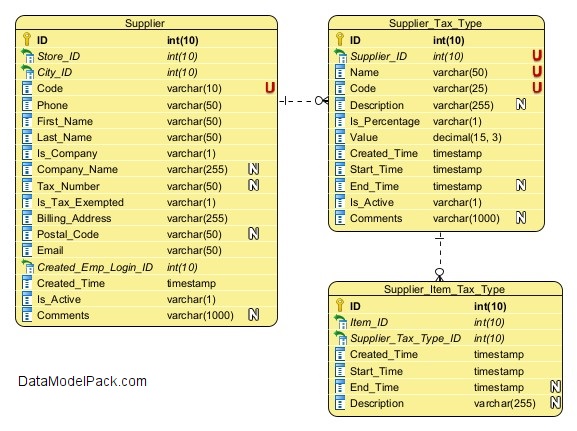

The Logical Data Model of the SUPPLIER Subject Area includes the following entities:

Entity: SUPPLIER

List of Store Suppliers.

| Attributes | |

|---|---|

| ID | PRIMARY KEY |

| Store_ID | Lookup for the Store for which the Supplier was created. NOT NULL |

| City_ID | Lookup for the City where the Supplier is located. NOT NULL |

| Code | Supplier code. NOT NULL UNIQUE |

| Phone | Supplier phone number. NOT NULL |

| First_Name | Supplier First Name NOT NULL |

| Last_Name | Supplier Last Name NOT NULL |

| Is_Company | Flag attribute to indicate if the Supplier is a company. NOT NULL |

| Company_Name | Company Name. If Is_Company is TRUE then Company_Name is mandatory |

| Tax_Number | Supplier Tax Number |

| Is_Tax_Exempted | Flag attribute to indicate if the Supplier is tax exempted. NOT NULL |

| Billing_Address | Supplier Billing Address. NOT NULL. |

| Postal_Code | Supplier address Postal Code. | Supplier email address. NOT NULL. |

| Created_Emp_Login_ID | Lookup for the Store Employee who created the Supplier record. |

| Created_Time | Date and Time when the Supplier record was created. NOT NULL |

| Is_Active | Flag attribute to indicate if the Supplier is still operational or is suspended. NOT NULL |

| Comments | Internal notes used for clarifications on record content. |

Entity: SUPPLIER_TAX_TYPE

List of Tax types applied by a Supplier.

| Attributes | |

|---|---|

| ID | PRIMARY KEY |

| Supplier_ID | Lookup for the Supplier for which the Tax Type record was defined. NOT NULL |

| Name | Tax Type name. Example: 'Value Added Tax' etc. NOT NULL |

| Code | Tax Type code. Example: 'VAT' etc. NOT NULL |

| Description | Tax Type description |

| Is_Percentage | Flag to indicate if the tax value is a percentage or a flat amount. Example: ⦁ If Is_Percentage is TRUE and Value is '40' then it means a 40% Tax ⦁ If Is_Percentage is FALSE and Value is '40' then it means 40 money amount expressed in Store default currency. See Entity: STORE, Attribute: Currency_ID for more information. NOT NULL |

| Value | Value of Tax. Example: ⦁ If Is_Percentage is TRUE then the Value is the Tax percentage. For example a value of '14.50' means 14.50% Tax. ⦁ If Is_Percentage is FALSE then the Value is the money amount fix Tax. For example a Tax Value of '14.50' means a Tax of 14.50 expressed in Store default currency. See Entity: STORE, Attribute: Currency_ID for more information. NOT NULL |

| Created_Time | Timestamp when the Tax type record was created. NOT NULL |

| Start_Time | The start timestamp from which the Tax type is applicable. NOT NULL |

| End_Time | The end timestamp after which the Tax type is not applicable. When the End_Time is NULL the Tax type is still applicable. |

| Is_Active | Flag attribute to indicate if the Tax_Type is still active. NOT NULL |

| Comments | Internal notes used for clarifications on record content. |

Entity: SUPPLIER_ITEM_TAX_TYPE

List of all Tax Types applied by a Supplier to an Item. A Supplier can apply many Tax Types to an Item.

| Attributes | |

|---|---|

| ID | PRIMARY KEY |

| Item_ID | Lookup for the Item to which the Supplier Tax Type was applied. NOT NULL |

| Supplier_Tax_Type_ID | Lookup for the Supplier Tax Type applied to the Item. NOT NULL |

| Created_Time | Timestamp when the Supplier Tax Type was assigned to Item. NOT NULL |

| Start_Time | The start timestamp from which the Supplier Tax Type is applicable. NOT NULL |

| End_Time | The end timestamp after which the Supplier Tax Type is not applicable. When the End_Time is NULL the Supplier Tax Type is still applicable. |

| Description | Description of the Supplier Tax Type applied to the Item. |

Accelerate every database schema design with powerful data models

We have already designed the data model and prepared the SQL scripts for creating the database schema objects.

© 2025 Data Model Pack · Terms of Use · Privacy